Tax Rate In Washington State 2025

Tax Rate In Washington State 2025. Washington imposes a 6.50% sales tax, an average local. Use our calculator to determine your exact sales tax rate.

Minimum Wage 2025 Wa State Tax Kiele Merissa, Washington sales and use tax rates in 2025 range from 6.5% to 10.4% depending on location. The washington state sales tax rate is 6.5%, and the average wa sales tax after local.

Tax rates for the 2025 year of assessment Just One Lap, Sign up for our notification service to get future sales & use tax rate change information. 6.50% 2025 washington state sales tax.

State Corporate Tax Rates and Brackets Tax Foundation, You’ll find rates for sales and use tax, motor vehicle taxes, and lodging tax. The washington sales tax rate in 2025 is between 6.5% and 10.4%.

Irs Tax Brackets 2025 Vs 2025 Annis Hedvige, There is no franchise tax, corporate income tax, or personal income tax in washington. 6.50% 2025 washington state sales tax.

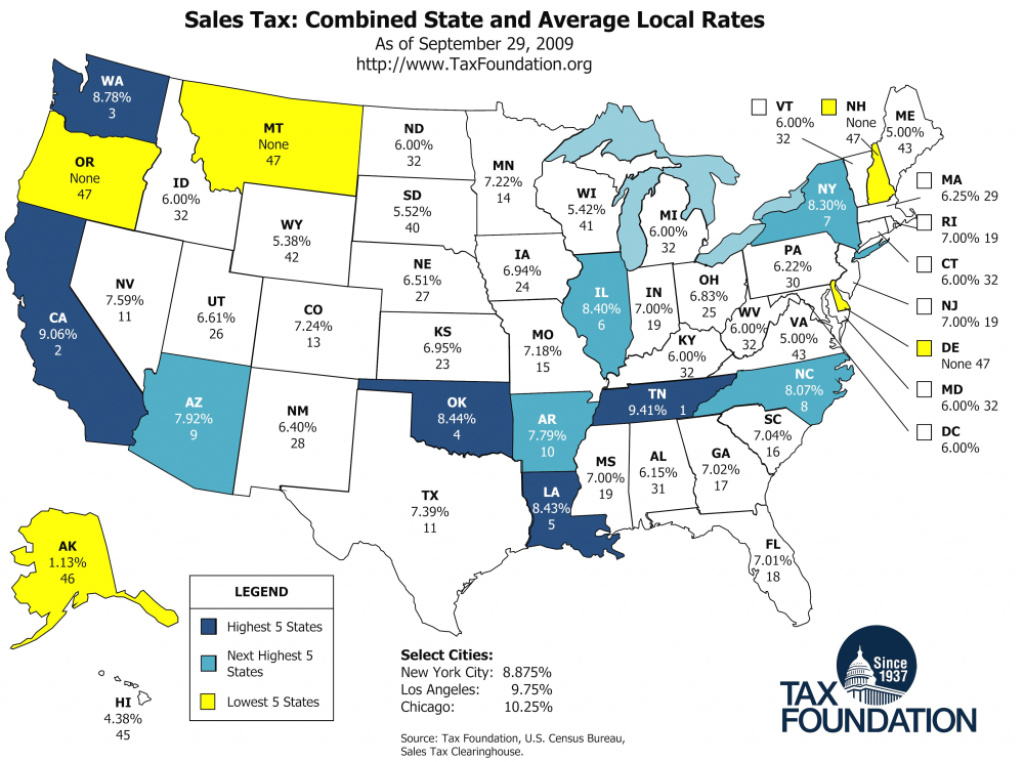

Monday Map Combined State and Local Sales Tax Rates, Use our calculator to determine your exact sales tax rate. Sales & use tax rates.

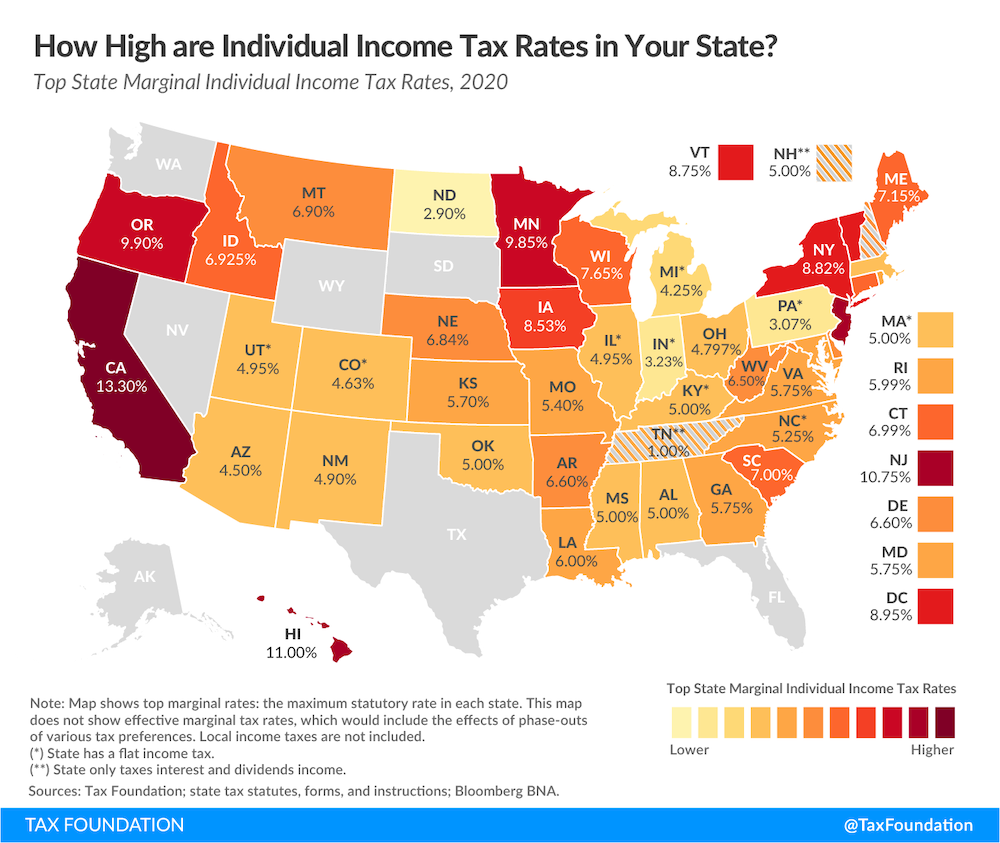

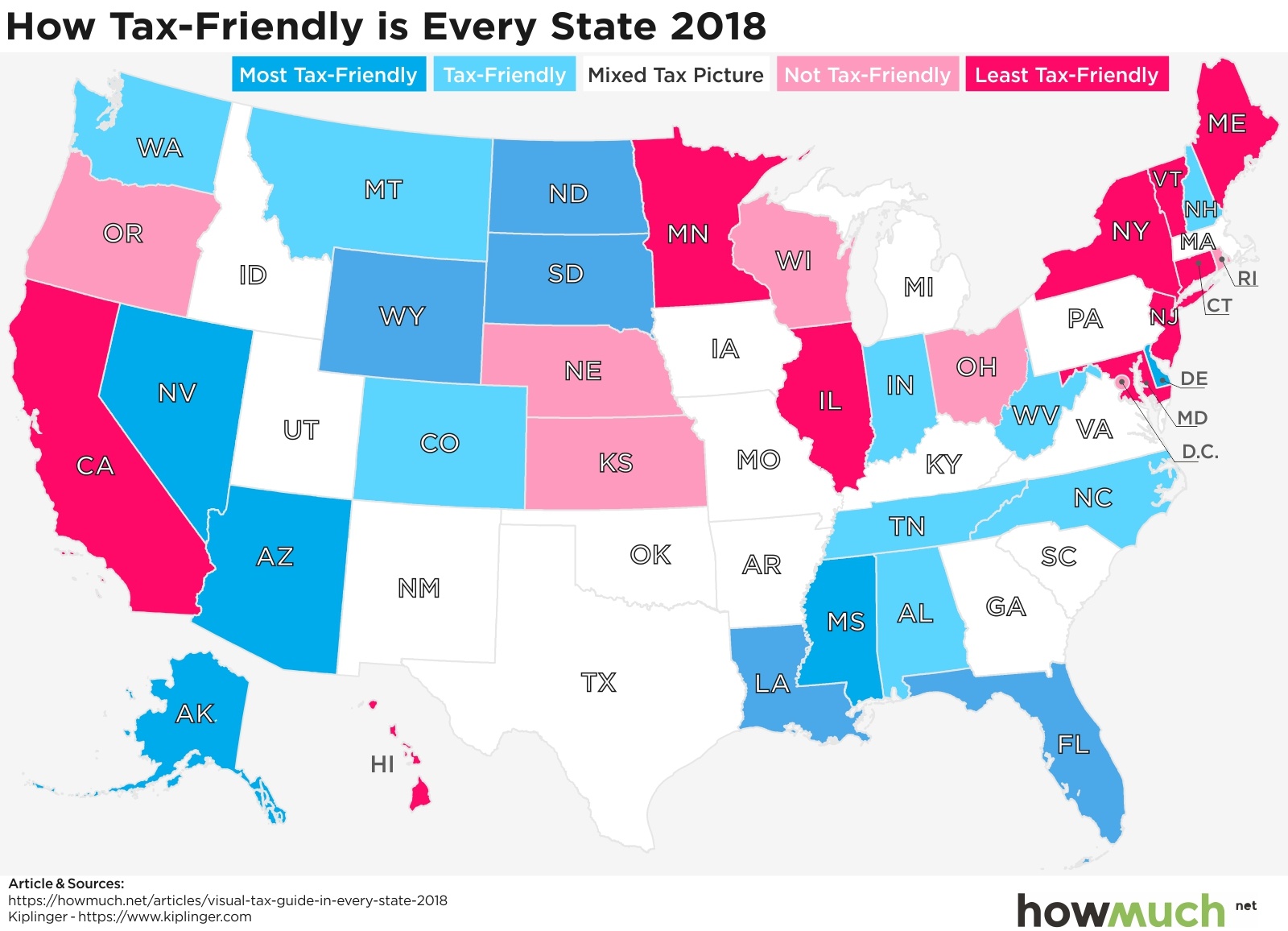

Visualizing Taxes by State, The quarter 1, 2025, washington state sales tax rate changes are now available. There is no franchise tax, corporate income tax, or personal income tax in washington.

.png)

Tax Brackets 2025 Single Person Angil Meghan, 2025 washington sales tax changes. Sales tax rate lookup tool.

Sales Tax By State Map Printable Map, The washington state sales tax rate is 6.5%, and the average wa sales tax after local. Look up 2025 washington sales tax rates in an easy to navigate table listed by county and city.

Payroll Taxes Filing Deadlines, Rates, and Employer Responsibilities, 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to 3.1%. Washington imposes a 6.50% sales tax, an average local.

2025 Top Tax Rate Dasha Emmalee, There is no franchise tax, corporate income tax, or personal income tax in washington. 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to 3.1%.